- What is the Exness Investment Calculator?

- Key Components

- Advantages

- Using the Exness Investment Calculator

- Benefits of Using the Exness Investment Calculator

- Interpreting the Results from the Exness Investment Calculator

- Comprehensive Results

- Example of Using the Exness Investment Calculator

- Key Features of the Exness Calculator

- Exness Calculator vs. Traditional Methods

- Frequently Asked Questions

What is the Exness Investment Calculator?

The Exness Investment Calculator is a tool that allows you to determine the potential profits and returns of your investments. This special tool, accessible on the Exness platform, enables traders to simulate various trading decisions and get insights into possible outcomes before executing real orders. It’s a priceless tool for creating trading strategies, asset allocation, and risk management to maximize the potential of each transaction.

Key Components

These calculators are essential tools for traders who want to make informed decisions and manage risk effectively. By using the Profit, Forex, Leverage, and Trading calculators together, traders gain a clear understanding of potential outcomes before entering a position. Each tool addresses a specific aspect of trading, but combined, they create a complete picture of market exposure, costs, and profitability. This ensures that every trade is backed by accurate data rather than guesswork, helping traders plan strategies with greater precision and confidence.

Profit Calculator:

- Function: Helps traders estimate the potential profit or loss of a trade based on several variables, including entry and exit prices, trade size, and currency pair.

- Usage: Enter the buy and sell prices along with the amount of units traded to receive an instant calculation of potential profit or loss, factoring in spreads and any applicable fees.

Forex Calculator:

- Function: Provides calculations related to currency trading, including conversions and required margin. This calculator is invaluable for forex traders looking to understand the financial implications of their trading decisions.

- Usage: Input the currency pair, account currency, trade size (in lots), and leverage to see required margin, pip value, and potential profit or loss.

Leverage Calculator:

- Function: Allows traders to understand the effects of leverage on their trades. Leverage can amplify both gains and losses, making it essential to calculate it precisely.

- Usage: Input the amount of capital invested, the leverage ratio, and the value of the position to calculate the total exposure and the required margin.

Trading Calculator:

- Function: Combines elements of the profit, forex, and leverage calculators to provide a comprehensive overview of a planned trade’s financial metrics.

- Usage: Fill in details such as instrument type, price levels, lot size, and leverage to get detailed information on margins, pip value, swap fees, and potential returns or losses.

Advantages

Together, these advantages empower traders to approach the markets with greater discipline and clarity. By applying effective risk management, detailed strategy planning, and smart financial optimization, traders can reduce uncertainty and improve consistency in their results. These benefits not only support short-term decision-making but also contribute to building long-term trading sustainability and confidence:

- Risk Management: Enables precise calculation of risk per trade, helping to maintain risk exposure within acceptable limits.

- Strategy Planning: Assists in meticulous planning of entry and exit points, expected returns, and stop-loss orders.

- Financial Optimization: Allows traders to use leverage more effectively, balancing the potential for higher returns against the risk of larger losses.

How to Access

The Exness Investment Calculator can be accessed directly from the Exness website under the tools or resources section. Users simply need to log into their Exness account to utilize this feature, ensuring all calculations are tailored to their specific trading conditions and account settings.

The Exness Investment Calculator is a powerful tool that assists traders in anticipating outcomes and provides them with financial information regarding potential trades. While it is very useful for maximizing returns, reducing risk, and adjusting strategies, it is also recommended for traders to conduct their own analysis before making decisions. Whether you are an experienced forex trader or new to the markets, the investment calculator is an essential tool for managing your trading portfolio more effectively.

Using the Exness Investment Calculator

The Exness trading calculator stands out as an essential ally for traders, serving as more than just a basic tool—it’s a vital companion that empowers individuals to navigate the intricate world of trading with confidence. This calculator functions as a reliable assistant, allowing traders to meticulously evaluate key financial parameters before executing trades. By facilitating thorough assessments of potential risks and rewards, it transforms decision-making into a more balanced and well-informed process.

At its core, the primary goal of the trading calculator is to streamline the often complex analysis of various financial elements associated with trading. Whether it’s calculating the cost of a point, understanding margin requirements, or figuring out swap rates, this tool is designed to simplify these processes significantly.

One of its most crucial features is the margin calculation. Margin refers to the portion of a trader’s capital that is set aside as collateral to support an open position. With the Exness trading calculator, users can effortlessly determine how much of their funds will be allocated based on the size of their trade, the financial instrument in question, and the leverage they are utilizing. This capability is particularly beneficial for strategic planning, as it helps prevent scenarios where a trader might find themselves without enough funds to uphold their positions, thereby safeguarding against unexpected market movements.

Another key function of this remarkable tool is its ability to project potential profits or losses associated with a trade. By entering specific parameters—such as the currency pair, trade volume, direction, and current market prices—traders receive immediate insights into possible outcomes. This feature is invaluable for evaluating the effectiveness of trading strategies, as it allows for proactive decision-making based on anticipated price fluctuations. Such foresight can be a game-changer, enabling traders to approach the market with a clearer understanding of their financial landscape.

Selecting Account Type and Trading Instrument

Choose Account Type:

- Procedure: When you open the Exness Investment Calculator, start by selecting the type of trading account you have with Exness, such as Standard, Pro, or ECN. This is important as different Exness account types have varying conditions like spreads, leverage options, and commission rates which can affect the calculation results.

- Impact: Each account type offers unique trading conditions that can influence the profitability and risk level of your trades.

Select Trading Instrument:

- Procedure: Choose the trading instrument you wish to trade. Exness offers a wide range, including forex pairs, commodities, indices, and cryptocurrencies.

- Impact: Different instruments have different trading characteristics, such as volatility and liquidity, which are critical for calculating potential profits and managing risks.

Inputting Position Size, Entry Price, and Leverage

Position Size:

- Procedure: Enter the size of your position, which is typically measured in lots or units depending on the instrument. The position size directly affects both the potential return and the risk of the trade.

- Impact: Larger positions increase both the potential profit and the potential risk. It’s crucial to balance the position size with your overall risk management strategy.

Entry Price:

- Procedure: Input the entry price at which you plan to enter the trade. This price should be based on your market analysis and trading strategy.

- Impact: The entry price helps determine the initial cost of the trade and is essential for calculating potential profit or loss based on target and stop-loss levels.

Leverage:

- Procedure: Select the amount of leverage you wish to apply to your trade. Leverage can significantly increase your exposure without requiring a proportional increase in your capital investment.

- Impact: While leverage can magnify returns, it also increases risk. It’s important to use leverage wisely, considering both the opportunities and the threats it poses.

Choosing Account Currency:

- Procedure: Choose the currency in which your trading account is denominated. This setting ensures that the calculator’s output reflects the actual monetary values you will see in your trading account for profits and losses.

- Impact: Selecting the correct account currency is vital for accurate calculations of profit, loss, and required margin. Currency conversion rates can affect these calculations if your account currency differs from the currency pair you are trading.

Benefits of Using the Exness Investment Calculator

The Exness Investment Calculator stands out as a remarkably useful tool, particularly for those venturing into the intricate world of finance. Its design and functionality are thoughtfully crafted, making it accessible even to novices who might feel overwhelmed by financial jargon.

At its core, this calculator enables users to swiftly and accurately assess potential profits from their investments, considering a variety of crucial parameters. These include the initial capital, the interest rate, and the duration of the investment. For traders, this is a game-changer; it allows them to grasp how different strategic choices can significantly influence their financial outcomes. Unlike conventional methods that often require complex mathematical computations and a solid grasp of finance, the Exness calculator features an intuitive interface. Users simply input basic information and, in a matter of moments, receive a clear picture of potential scenarios, which can be both enlightening and empowering.

Moreover, the investment calculator serves as a safeguard against potential risks. By shedding light on how various factors impact investments, traders can make more informed and balanced decisions. For instance, the tool helps evaluate how market fluctuations or new economic indicators might affect overall profitability. This kind of insight is invaluable, enabling traders to adapt their strategies promptly, especially during periods of high market volatility where conditions can change rapidly.

Another noteworthy benefit of the Exness calculator is its utility in planning for long-term financial objectives. Traders with specific savings goals can easily calculate how much they need to invest and what kind of returns to aim for, allowing for a more structured and focused approach to their financial journey. This transforms the often-chaotic investment process into a well-organized plan of action.

Accessibility is yet another feather in the cap of the Exness platform. Traders can reach the calculator from virtually anywhere in the world, at any hour, making it incredibly convenient to conduct calculations whenever it suits them. This flexibility is particularly advantageous in today’s fast-paced financial landscape, where timely decision-making is crucial.

How to Access

The Exness Investment Calculator can be accessed directly from the Exness website under the tools or resources section. Users simply need to log into their Exness account or open the Exness web terminal to utilize this feature, ensuring all calculations are tailored to their specific trading conditions and account settings.

Using the Exness Investment Calculator allows you to thoroughly plan each trade by considering various financial metrics and trading conditions. By meticulously inputting details such as account type, trading instrument, position size, entry price, leverage, and account currency, you can gain a comprehensive overview of potential outcomes. This process not only aids in maximizing potential returns but also enhances your ability to manage associated risks effectively. Whether you are a seasoned forex trader or a newcomer to the markets, the investment calculator is an essential tool for managing your trading portfolio more adequately.

Interpreting the Results from the Exness Investment Calculator

To truly grasp the workings of the Exness investment calculator, we need to explore the intricate mechanisms that power this invaluable tool. It acts as a guiding beacon for users, helping them navigate the complex waters of trading by estimating potential profits or losses based on specific inputs.

At the outset, it’s crucial to recognize the importance of entering key parameters for accurate calculations. During the Exness login process, users must input several foundational pieces of information: the initial amount they wish to invest, the level of risk they are comfortable with, their target profit margin, and the duration of the trading period. These variables form the backbone of the calculator’s functionality.

As soon as you input the initial investment amount, the calculator springs into action, processing the information and generating a variety of potential outcomes. For instance, if you choose to invest in an asset that you anticipate will appreciate in value, the calculator can vividly illustrate the earnings you might expect should the asset reach a predetermined price. It also incorporates margin requirements, which are essential for understanding the capital needed to open a trading position. Here’s how to interpret key aspects of the results:

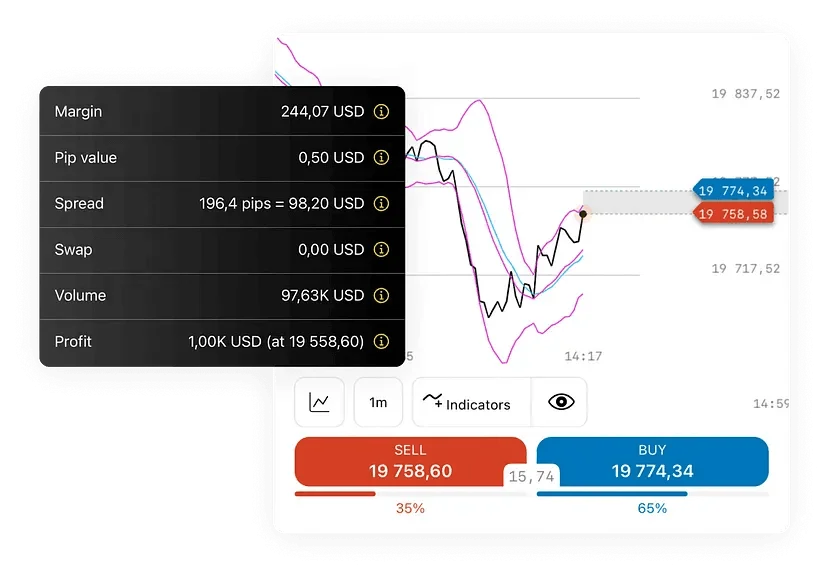

Margin Requirements and Leverage Impact

Margin Requirements:

- Explanation: This is the amount of capital required to open and maintain your position. It is calculated based on the leverage you’ve chosen and the total value of the position.

- Interpretation: Higher leverage reduces the margin requirement, allowing you to open larger positions with less capital. However, this also increases the risk as it magnifies both potential profits and losses. A lower margin requirement indicates higher leverage is being used, which can lead to greater exposure and risk.

Leverage Impact:

- Explanation: Leverage allows you to control a large position with a relatively small amount of capital by borrowing funds.

- Interpretation: While leverage can significantly increase potential returns, it also amplifies potential losses. It’s important to balance leverage with your risk tolerance. The calculator shows how different levels of leverage impact the margin required and overall exposure.

Spread Cost and Commissions

Spread Cost:

- Explanation: The spread is the difference between the bid and ask price of the trading instrument. It represents the cost paid each time a position is opened.

- Interpretation: The calculator shows how much the spread costs based on the position size. Lower spreads generally mean lower trading costs, which is critical for strategies like scalping where multiple trades are made in a session. For example, a tight spread is advantageous for high-frequency trading as it reduces the cost per trade.

Commissions:

- Explanation: Some account types or instruments may include a commission per trade. This fee is charged by the Exness broker for executing trades.

- Interpretation: Understanding the commission structure is important as it impacts the overall cost of trading. High commissions can eat into profits, especially for high-volume traders. The calculator will display the total commission costs based on the number of trades and position size.

Swaps and Position Holding Costs

Swaps:

- Explanation: Swap fees or overnight interest is charged when a position is held open overnight. The rate depends on the differential between the interest rates of the traded currencies.

- Interpretation: The calculator provides an estimate of swap costs based on current rates. Traders need to consider these costs when planning to hold positions overnight or longer, as they can affect profitability. Positive swaps can benefit traders holding certain positions, while negative swaps represent a cost.

Position Holding Costs:

- Explanation: These are the costs associated with holding a position over an extended period, including swap fees.

- Interpretation: Understanding these costs helps traders decide whether to hold positions long-term or close them before incurring significant holding costs. The calculator will estimate the total holding costs based on the duration and swap rates.

Pip Value for the Selected Instrument

Pip Value:

- Explanation: Pip value indicates how much a one-pip movement in the exchange rate affects the monetary value of the position.

- Interpretation: This is crucial for understanding potential profit or loss from price movements. The calculator shows the pip value, which helps in setting precise risk management measures, such as stop-loss orders. Pip value varies with the currency pair, the size of the trade, and the currency in which the account is denominated.

Comprehensive Results

Profit and Loss Estimations:

- Explanation: The calculator provides an estimate of potential profit or loss based on the input variables.

- Interpretation: By analyzing these estimates, traders can assess the risk/reward ratio of their trades. It helps in making decisions on whether a trade aligns with their risk management strategy.

Risk Management Insights:

- Explanation: The results include critical risk management metrics like required margin, leverage impact, and stop-loss levels.

- Interpretation: These insights enable traders to manage their exposure effectively and set appropriate risk limits. It is essential for maintaining a balanced and controlled trading approach.

Scenario Analysis:

- Explanation: The calculator allows for simulating different trading scenarios by adjusting variables like position size, leverage, and entry/exit prices.

- Interpretation: This feature helps traders understand the potential outcomes of various strategies, aiding in the development of robust trading plans.

The Exness Investment Calculator provides comprehensive results that help traders make more informed decisions. By accurately interpreting the implications of margin requirements, leverage, spread costs, commissions, swap rates, and pip values, traders can better manage their risks and optimize their trading strategies. Each of these elements plays a crucial role in the financial outcomes of trades, and understanding them is essential for achieving trading success.

Example of Using the Exness Investment Calculator

To truly grasp the inner workings of the Exness investment calculator, it’s essential to dive into practical examples that illustrate its functionality. By exploring these scenarios, you not only gain clarity on how the calculator aids in investment planning but also discover the various factors that influence the outcome of your calculations.

The investment calculator serves as a dynamic tool for traders and investors, enabling them to project potential profits and weigh associated risks. However, it’s only by examining specific situations that you can fully appreciate its capabilities and the value it brings to your trading strategy.

Let’s take a closer look at some illustrative examples. For instance, imagine you’re starting with a certain amount of initial capital. The size of this capital can dramatically alter your potential returns. If you increase your initial investment, you may find that your projected profits rise accordingly, showcasing the direct relationship between capital and profit potential.

Similarly, consider the impact of trading volume. This factor can significantly influence your overall results. If you decide to trade in larger volumes, the calculator will reflect how this shift can amplify both your potential gains and risks. Understanding this interplay is crucial for making informed decisions in your trading endeavors.

Leverage is yet another critical variable to keep in mind. It can be a double-edged sword; while it has the potential to magnify your profits, it also increases your exposure to risk. By manipulating the leverage level in the calculator, you can see firsthand how it affects your projected earnings. This understanding is vital for anyone looking to navigate the complexities of trading successfully.

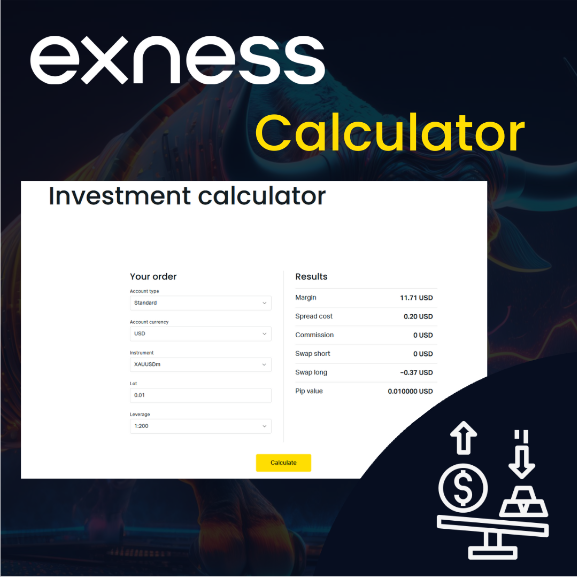

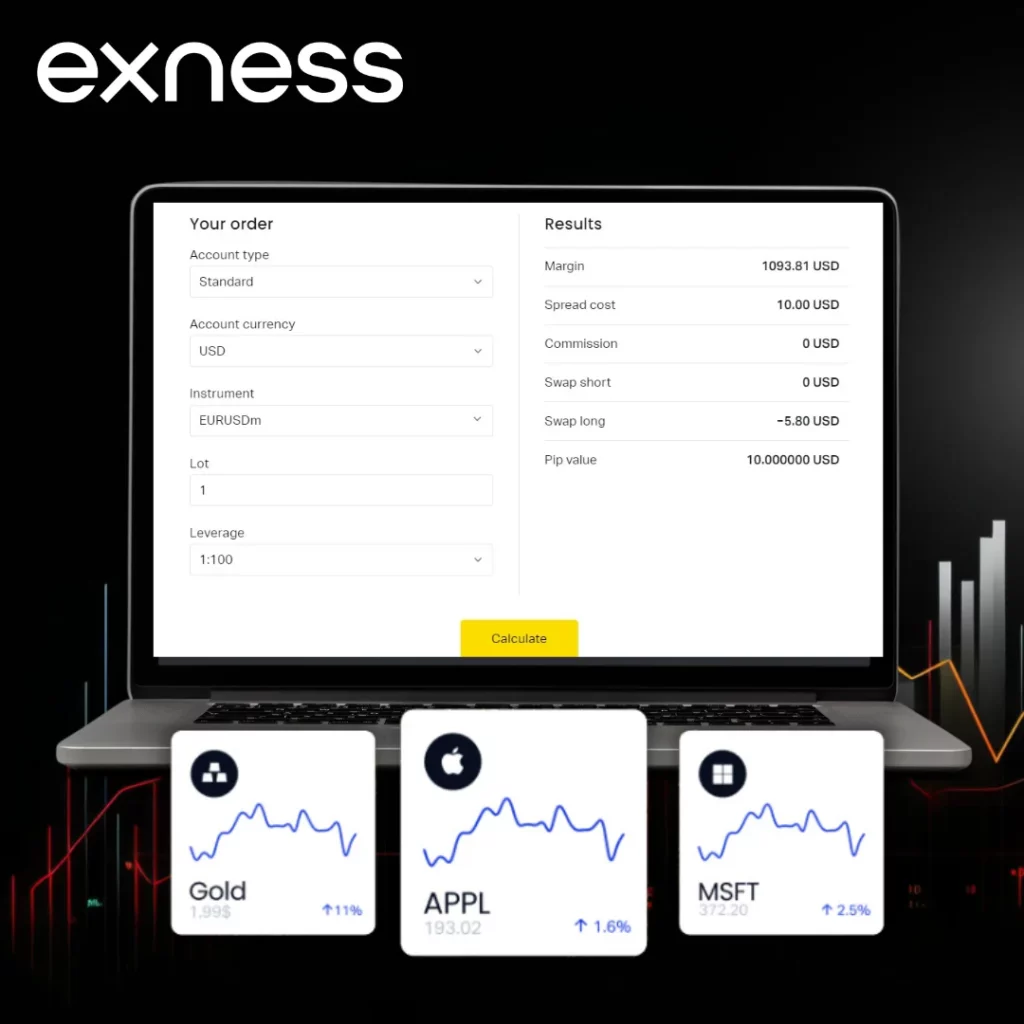

Scenario:

A trader wants to calculate potential profits and the required margin for a forex trade on the EUR/USD pair.

- Account Type: Standard

- Trading Instrument: EUR/USD

- Account Currency: USD

- Position Size: 1 lot (100,000 units)

- Entry Price: 1.1800

- Exit Price: 1.1850

- Leverage: 1:100

Steps to Use the Calculator:

- Select the Account Type: Choose ‘Standard’ from the dropdown menu.

- Input Trading Instrument: Type in or select ‘EUR/USD’ from the list.

- Set the Account Currency: Ensure ‘USD’ is selected.

- Enter the Position Size: Input ‘1 lot’ equivalent to 100,000 units of the base currency.

- Provide Entry and Exit Prices: Enter ‘1.1800’ for the entry price and ‘1.1850’ for the exit price.

- Choose Leverage: Select ‘1:100’ from the leverage options.

Key Features of the Exness Calculator

The Exness Calculator serves as an all-in-one solution for evaluating trades with accuracy and confidence. By combining profit estimation, risk measurement, customizable scenarios, and detailed profitability analysis, it provides traders with a clear view of both opportunities and risks before committing capital. This makes it an indispensable tool for planning strategies, controlling exposure, and maintaining disciplined trading practices in dynamic market conditions.

Understanding Potential Profits and Risks:

- Profit Calculations: The calculator allows traders to input hypothetical entry and exit points for a trade to see the potential profit or loss. This helps in planning trades more effectively and setting realistic profit targets.

- Risk Assessment: It also calculates the required margin based on the leverage used, helping traders understand the amount of capital at risk and manage their trading capital more efficiently.

Customizable Investment Scenarios:

- Versatility in Parameters: Traders can adjust various parameters like leverage, position size, and stop-loss and take-profit levels to see how these factors affect potential outcomes.

- Scenario Analysis: This feature allows traders to simulate different market conditions and trading decisions without financial loss, helping them identify the most rational trading strategy for a particular situation.

Integral for Traders:

- Profitability Analysis: The calculator helps traders analyze potential changes individually, offering a holistic understanding of trade outcomes.

- Informed Decision-Making: By presenting comprehensive profit analysis, risk identification, and margin requirements, the calculator enables traders to make informed decisions, plan trades strategically, and manage finances effectively.

Exness Calculator vs. Traditional Methods

1. Speed and Efficiency:

- Exness Calculator: Provides instant calculations for profit, loss, margin requirements, and more with just a few inputs.

- Traditional Methods: Typically involve manual calculations or using separate tools, which can be time-consuming and error-prone.

2. Accuracy:

- Exness Calculator: Automatically accounts for current market conditions, exact leverage settings, and instrument specifications.

- Traditional Methods: Depend on the trader’s familiarity with financial formulas and market specifics, with a higher risk of miscalculations.

3. Accessibility:

- Exness Calculator: Accessible online without needing downloads or specific hardware, allowing for on-the-go calculations.

- Traditional Methods: Often require access to detailed financial tables, spreadsheets, or desktop software, which may not be as convenient.

4. Comprehensive Analysis:

- Exness Calculator: Integrates various financial calculations into one tool, providing a holistic overview of potential trade outcomes.

- Traditional Methods: Typically need separate tools for different analyses, making comprehensive assessment challenging.

Integrating the Calculator into Your Investment Strategy

- Pre-Trade Analysis: Use the calculator to assess potential profit and risk before entering a trade. Input different scenarios to understand how market price variations, leverage, or position size could affect the outcome.

- Risk Management: Regularly use the calculator to determine appropriate leverage and margin for trades, ensuring you are not overexposed in any position.

- Performance Review: After closing trades, compare expected results with actual outcomes using the calculator to gain insights into the effectiveness of your trading strategy.

- Strategic Adjustments: Adjust trading strategies and parameters based on calculator insights, such as reducing leverage or position sizes if risk levels are consistently high.

- Educational Tool: Especially for newer traders, the calculator serves as an educational tool to better understand the financial mechanics of trading.

Conclusion

The Exness Investment Calculator is a superior tool compared to traditional methods, offering speed, efficiency, accuracy, and accessibility. By integrating this calculator into your investment strategy, you can make more informed decisions, manage risks effectively, and potentially enhance trading performance. This tool supports operational efficiency and contributes to strategic trading growth and financial knowledge.

Frequently Asked Questions

What is the best leverage for a $10 account on Exness?

For a $10 account on Exness, it’s advisable to use lower leverage to minimize risk, especially if you are a beginner. While Exness offers leverage up to 1:2000, using a more conservative leverage like 1:100 or 1:200 may help manage risk better. High leverage can magnify both profits and losses, but with a small account, the goal should be to preserve capital and learn.